Russia's War on Ukraine

Analysing the impacts of Russia's invasion of Ukraine on global energy markets and international energy security

One year on

One year on from Russia’s invasion of Ukraine, the global energy landscape has changed dramatically. Regions around the world have experienced soaring prices that have hit consumers hard, all against a geopolitical backdrop with energy security at its heart. What’s more, the world’s dependence on fossil fuel consumption, including the price and resource volatility that entails, has come into sharp focus.

The economic disruption caused by the war in Ukraine has amplified calls for an accelerated energy transition. A shift that would move countries away from highly polluting fuels, often supplied by only a handful of major producers, to sources of low carbon energy such as renewables and nuclear. Not least in Europe, where the ripple effects of the war have been felt acutely and Russian gas has historically dominated imports. A mild winter and lower-than-expected demand have seen the region’s gas stocks remain relatively stable through the coldest months of the year. While this has helped to ease the impact of supply cut-offs from Russia, the outlook for winter 2023 may be more challenging. The EU faces a potential shortfall of almost 30 billion cubic metres of natural gas this year. But the gap can be closed and the risk of shortages avoided through greater efforts to improve energy efficiency, deploy renewables, install heat pumps, promote energy savings and increase gas supplies.

High inflation and supply chain disruptions, resulting from the conflict and compounded by the fallout of the COVID-19 pandemic, have also shone a light on the risk of over-reliance on highly concentrated manufacturing and critical minerals. The culmination of these factors has led to sweeping government interventions to protect consumers and shield industry from spiralling energy and technology costs. Many countries and regions are now looking at how they can leverage policy to fast track a clean energy transition alongside economic recovery and avoid repeating past mistakes. The Inflation Reduction Act in the US, the REPowerEU plan in Europe and the GX Green Transformation programme in Japan are just a few examples of policymakers taking bold action.

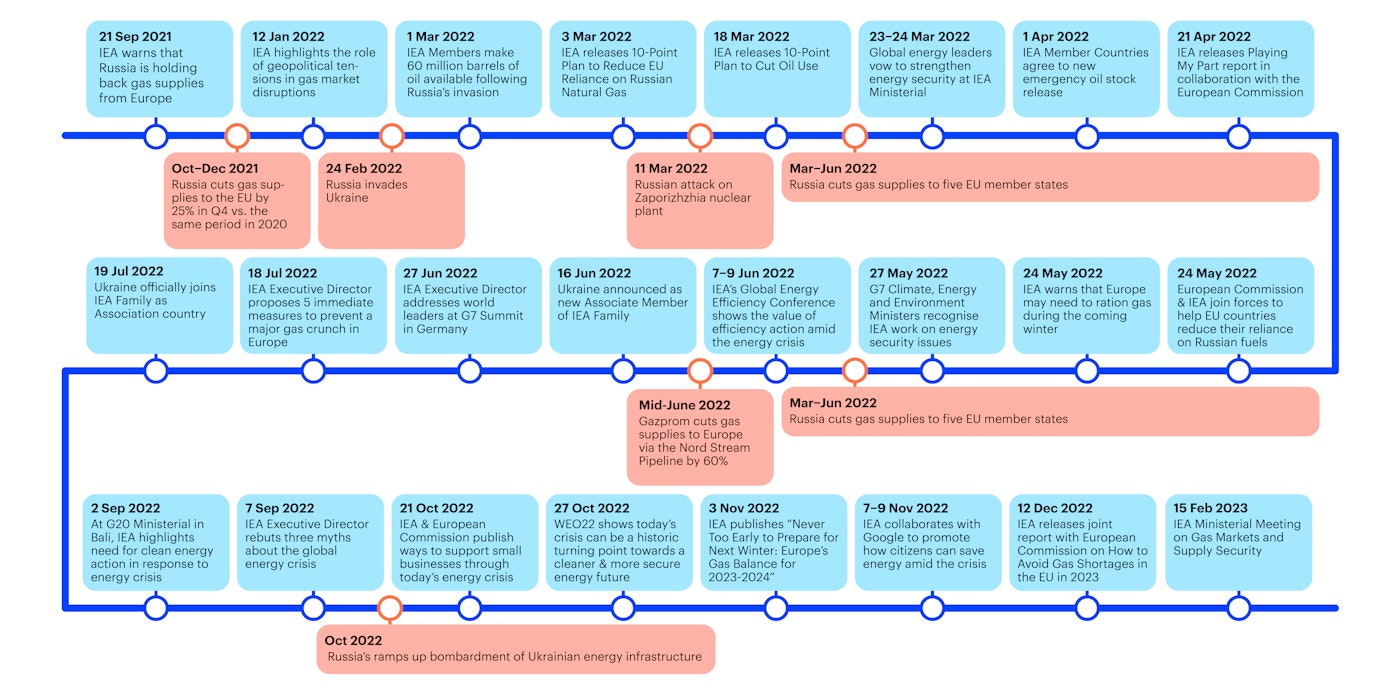

Since the start of the crisis, the IEA has been monitoring the implications of Russia's invasion of Ukraine for the country’s energy system and on global markets. In support of Ukraine directly, the IEA signed a two-year joint work programme to support its recovery including short- and long-term energy priorities such as power-system security, hydrogen, renewables, biogas and collaboration on data and statistics.

More broadly, IEA member countries have agreed on two occasions to take the exceptional step of releasing oil from their emergency reserves to reduce the strains in markets and send a unified message that there will be no shortfall in supplies as a result of Russia’s invasion. In the first collective action following the invasion, agreed on 1 March 2022, IEA member countries committed to release 62.7 million barrels of emergency oil stocks. On 1 April, they agreed to make a further 120 million barrels available from emergency reserves, the largest stock release in the IEA’s history, which coincided with the release of additional barrels from the US Strategic Petroleum Reserve. The two coordinated drawdowns in 2022 are the fourth and fifth in the history of the IEA, which was created in 1974. Previous collective actions were taken in 1991, 2005 and 2011.

Impact

Russian total oil exports, January 2022 - January 2023

OpenRussian oil output and exports are holding up despite sanctions, but bigger losses loom

But in a sign that Russia may be struggling to find buyers for all of its barrels, Deputy Prime Minister Alexander Novak said in early February the country would curb output by 500 kb/d in March rather than sell to those that comply with the G7 price caps. Even if supply falls sharply, Russia will continue to play an outsized role on global oil markets, ranking as the world’s third largest producer behind the United States and Saudi Arabia.

Share of European Union gas demand met by Russian supply, 2001-2022

OpenEurope’s consumption of Russian gas is plummeting

The EU's reliance on Russian gas has grown steadily over the past decade. The bloc's gas consumption declined only marginally over this period, but production has fallen by two-thirds since 2010 and the gap has been filled by rising imports. As a result, Russia's share of total EU gas demand increased from 26% in 2010 to an average of over 40% through 2018-2021. The IEA was among the first to raise concerns about this rising dependence.

Russia more than halved its pipeline gas supplies to the EU in the past year. But the European gas market proved to be resilient as nations were able to fill their storage sites to above 95% capacity by ramping up non-Russian supplies and rapidly reducing consumption. Consequently, Russia's share of European gas demand fell from 23% in 2022 to below 10% in January 2023.

Learn more in our 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas

IEA renewable electricity capacity forecast revisions for the European Union and selected countries, December 2021 - December 2022

OpenRenewables are on the rise

Renewable electricity capacity in the EU is projected to double over the 2022-2027 period as energy security concerns add to climate ambitions. Many European countries passed or proposed action plans with even more ambitious targets, increased policy support for renewables, and addressed related non-financial challenges. The IEA’s forecast for growth in the EU has been revised upward significantly (by over 30%) from last year’s estimate, led by Germany (55% higher) and Spain (65% higher). Germany has increased renewable electricity targets, introduced higher auction volumes and improved remuneration for distributed solar PV while reducing permitting timelines. Spain has streamlined permitting for solar PV and wind plants, and increased grid capacity for new renewable energy projects.

Key analysis

IEA's response to the crisis

Explore more data

More analysis

-

National Reliance on Russian Fossil Fuel Imports

How do countries rely on and consume Russian energy?

-

Europe’s energy crisis: Understanding the drivers of the fall in electricity demand

-

Europe’s energy crisis: What factors drove the record fall in natural gas demand in 2022?

-

Where things stand in the global energy crisis one year on

-

Fossil Fuel Subsidies in Clean Energy Transitions: Time for a New Approach?

A "price gap-plus" approach could bring carbon prices and environmental costs into the equation.

-

Fossil Fuels Consumption Subsidies 2022

-

The global energy crisis pushed fossil fuel consumption subsidies to an all-time high in 2022

-

Background note on the natural gas supply-demand balance of the European Union in 2023