Norway Oil Security Policy

Part of Oil Security Policy

Norway has comprehensive legislative and regulatory frameworks in place to respond to an oil emergency, as the country’s economy remains very reliant on oil, especially for transport. According to the terms of Norway’s participation in the IEA, the country is not obliged to adhere to oil emergency response measures, as a major net exporter of oil. However, not only does Norway participate in all of the oil emergency work of the IEA, it also participated in IEA Collective Actions, most recently in March 2022. The oil emergency framework is primarily geared to releasing oil stocks held by the industry, and the country’s oil security system is part of the national security structure, Civil Emergency Planning (CEP), under the Prime Minister's Office, within which separate ministries take responsibility for assuring security in their respective fields. Ministry of Trade, Industry and Fisheries has a key role in emergency situations.

Following Russia’s invasion of Ukraine in February 2022, and the expected downgraded role of Russia as a global oil and natural supplier, Norway is strengthening its role as a stable global supplier of oil and gas, while at the same time paving the way to the 2050 net zero world.

Pipelines

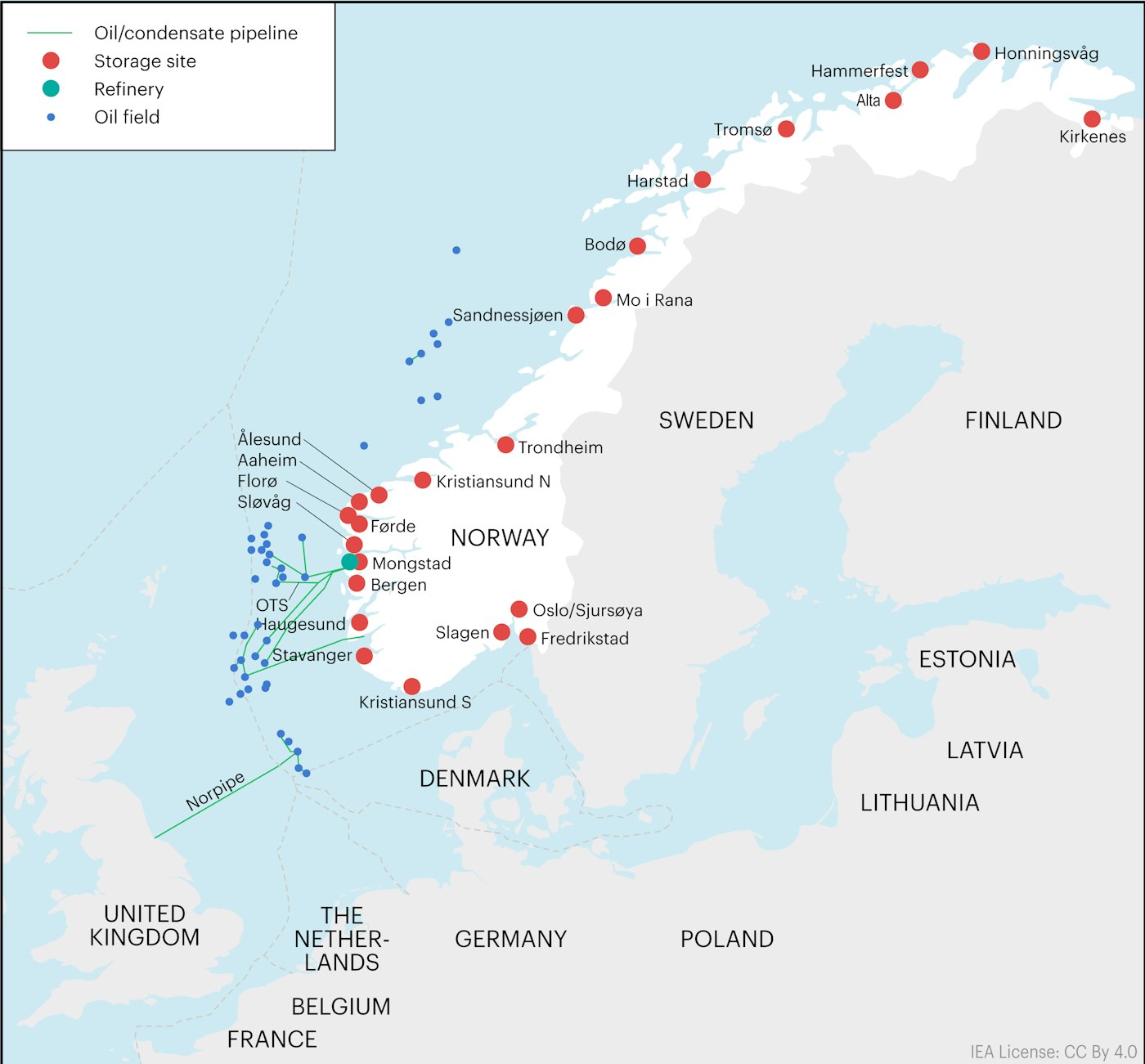

Norway’s upstream oil infrastructure is well developed with an extensive network of underwater pipelines linking offshore oil fields with onshore terminals. There is no integrated system for all oil pipelines and terminals: the infrastructure on the Norwegian Continental Shelf is divided into four different systems connected to the terminals at Sture, Mongstad and Kårstø in Norway and Teesside in the United Kingdom. At the Norwegian terminals, oil is stored in rock caverns before most of it is loaded onto tankers for export. Crude oil is often loaded directly onto tankers at the offshore fields, although there are onshore terminals near some of the larger fields.

Norway’s most significant oil port by tonnage is the Mongstad oil terminal, located near Bergen/Stavanger on the west coast. The terminal is operated by Equinor and is jointly owned by Equinor and Petoro. The Mongstad terminal is linked by pipeline to offshore fields, and is also connected to Norway’s only remaining refinery. Other significant oil ports include Sture (operated by Equinor, and also on the west coast close to Bergen) and Slagen (operated by Exxon, located near Tønsberg). The Sture facility is comprised of two jetties able to berth tankers up to 300 000 deadweight tonnes, plus five artificial rock caverns for crude with a total capacity of 6.3 million barrels (mb). The region around the capital, Oslo, in the east also has notable port activity. Refined products are mainly transported by sea tankers from the Mongstad refinery to terminals around the country.

The owners and users of oil infrastructure negotiate access agreements between themselves. Equinor operates the 115-kilometre Oseberg Transport System (765 thousand barrels per day [kb/d]) connecting the Oseberg field with the receiving Sture terminal. Equinor is also the operator of the 212-kilometre long Grane oil pipeline (265 kb/d), linking its Grane field to the Sture terminal. The company also manages the twin pipeline system called Troll I and II (565 kb/d) connecting all crude from Troll B and C, Kvitebjørn, Fram, Gjøa og Valemon to the Mongstad Crude oil terminal. The Norpipe oil AS pipeline is owned and operated by ConocoPhillips Skandinavia AS. This oil pipeline (810 kb/d) is about 354 kilometres long, starting at the Ekofisk Centre and crossing the United Kingdom Continental Shelf to come ashore at Teeside in the United Kingdom.

In Norway, oil transport infrastructure makes up a smaller part of the value chain than gas transport infrastructure. In many cases, oil is loaded directly onto tankers at the offshore fields (buoy-loading). For some of the larger field developments in Norway, it was considered more appropriate to build onshore oil terminals. Other fields have subsequently been connected to this infrastructure. The oil transport system is regulated according to third-party access regulation. The cost of transport is low compared to the oil price, and buoy-loading directly onto tankers at oil fields is an alternative to using pipelines and terminals.

Crude oil net exports in Norway, 2000-2021

OpenRefining

There is only one operational refinery left in Norway, Equinor's 230 000 barrels per day (bbl/d) Mongstad plant on the west coast. The refinery is part of a larger complex which includes processing of natural gas liquids, a crude oil terminal, a cogeneration plant and the world’s largest technology centre for CO2 capture from flue gas. The refinery processes both domestic crude and imports, mainly from West Africa.

Various projects are being considered to reduce emissions at the Mongstad refinery, but no investment decisions have yet been taken. Due to overcapacity in the global refining sector and declining domestic demand, a reduction in the refinery’s capacity or a closure is possible. However, a premature closure of Mongstad would leave Norway with substantial oil product import requirements, potentially compromising the security of oil supply. As the Mongstad refinery is well connected with other energy related activities in the region, its continued operation could provide opportunities for the production of low-carbon fuels and other technologies needed for the energy transition, with export potential.

In June 2021, ExxonMobil permanently closed the 116 000 bbl/d Slagen refinery and is in the process of converting it into a fuel handling terminal.

The majority of Norway’s oil product production is exported. Norway is a net exporter of gasoline, gasoil/diesel, naphtha and fuel oil while it imports small quantities of jet/fuel kerosene and fuel oil. However, Norway’s net oil product exports have declined significantly after 2021 due to the closure of the Slagen refinery.

Norway's top net exporting destinations for oil products are the Netherlands, Belgium, Nigeria, the United Kingdom, Denmark and France. Norway imported oil products from Russia.

Oil products' net exports in Norway, 2000-2021

OpenStorage

Norway has 26 sites for its storage facilities, mostly located along the coastline. The largest storage sites are located at Mongstad, Oslo and Slagen. The total storage capacity of oil storages in Norway is almost 6.3 million cubic metres combined, although part of that is for processing and blending of offshore crude, condensate and natural gas liquids production and do not serve domestic consumption.

Norway’s oil infrastructure, 2022

Organisation

The oil security system in Norway is part of the national security structure, CEP under the Prime Minister's Office, within which separate ministries take responsibility for assuring security in their respective fields. The Ministry for Trade, Industry and Fisheries (MTIF) is responsible for oil contingency planning, emergency preparedness, emergency stockholding and crisis management in Norway. However, decisions to initiate a stock release as part of an exercise or joint IEA collective action is made jointly with the Minister for Trade, the Minister for Foreign Affairs and the Minister for Petroleum and Energy. In certain, more serious situations, the whole of government could be involved in the decision-making process if deemed necessary.

The responsibility for security of supply of fuel was transferred from the Ministry of Petroleum and Energy to MTIF in 2017, and applies for the whole system, starting from processing in the refinery sector to the end user (gas stations). That change included the transfer of the law and regulation on emergency storage of petroleum products.

The 2006 Regulation relating to Petroleum Product Storing for Emergency Purposes and the 2011 Act on Business and Industry Preparedness provide for the legal basis of the country’s oil emergency system. Both give the MTIF wide-ranging powers to prepare for and manage oil supply crises, including implementing a stock release, ordering fuel companies to deliver products to specified consumers, temporarily taking operational control of the assets of fuel companies, and instructing fuel companies to provide data relating to imports, exports, storage and the distribution of crude oil and oil products. The 2006 regulation has been enacted pursuant to the terms (articles 1-2) of the 2006 Act of Petroleum Product Storing for Emergency Purposes (APP). The 2011 Act on Business and Industry Preparedness regulates the interaction and cooperation between the commercial and the public sectors concerning disruption of supplies.

The government is considering updating the APP. A number of amendments to the Act are being considered, including changes to the quantity and categories of oil that suppliers are obliged to hold. A revision of the component of crude oil that companies can hold as part of their emergency stockholding requirement will likely be necessary also following the closure of the Slagen refinery in 2021.

While the system works well and is well known to stakeholders, Norway has not prepared an Emergency Handbook specifying exact roles, responsibilities and steps of action in case of different levels of crises. While the government conducts vulnerability and threat assessments, it believes that most supply challenges can be resolved without specific planning or measures, relying instead on industry to address most supply issues.

During the last decade, there have been no instances in which the government has had to intervene in fuel markets; industry operators themselves deal with any small-scale localised fuel supply disruptions caused by adverse weather conditions or short-term logistical issues.

The Norwegian National Emergency Strategy Organisation (NESO) is comprised of representatives from the MTIF, the Ministry of Petroleum and Energy, the Ministry of Foreign Affairs, the Ministry of Finance, the statistical office (Statistics Norway), and the Council for Fuel Preparedness, an industry advisory group. In the event of a supply emergency, the NESO can be convened within a matter of hours.

The Council for Fuel Preparedness was formally established in 2018 to advise the government on issues related to the supply and distribution of oil products in Norway, as well as to increase collaboration between government and the industry on issues relating to oil security. The Council consists of 9 representatives from the main fuel suppliers in Norway. There are safeguards in place to prevent anti-competitive behaviour among fuel suppliers who sit on the Council. In case of crises, the Council serves as a liaison between the government and the industry facilitating decision‑making.

Emergency oil stocks

While Norway has no stockholding obligation towards the IEA, the 2006 Act on Contingency Storage of Petroleum Products places a stockholding obligation on industry.

The organisation and holding of the stocks are conducted by the obligated companies. They report to Statistics Norway quarterly, who in turn informs the ministry that the companies are compliant (or not) with the regulation. MTIF can also ask any company to provide updated stock data at any time and in emergency situations the government has the authority to instruct the companies on how, when and where to release the stocks.

In practice, the companies keep stocks by having a larger inventory than what is needed for commercial purposes. In case of a release of emergency stocks, obligated companies simply no longer reserve these volumes, and allow them to go to market through normal market mechanisms. Emergency stocks are normally co-mingled with stocks held for commercial purposes.

Stock composition

The 2006 Regulation stipulates that any company which produces and imports more than 10.000 m3 per year of any product listed in the regulation, has an emergency storage requirement equal to 20 days of consumption. The products currently on the list for emergency storage are divided into three categories:

- Category 1: Gasoline

- Category 2: diesel, light fuel oil, firing paraffin, jet fuel, marine gas oils

- Category 3: Heavy distillates, heavy fuel oil.

Companies are allowed to hold up to 40% of their obligation as crude oil, condensate or semi-finished products. Stocks can also be kept as components – but the requirement states that all components must be stored in order to make up the finished product requirement. There are some exceptions to the storage requirement, such as sales for export and sales to the defence forces in the country. Legislation provides for fines of up to NOK 10 million (Norwegian kroner) for breaching the stockholding requirements, but spot-checks are not frequently carried out to verify reported stock levels. There is also no explicit provision in place to reduce or waive the biofuels blending mandate in the event of a prolonged supply shortage or logistical issues. This could pose an impediment to effectively responding to a supply disruption, as most biofuels are imported, and as the already substantial blending mandate increases further.

Norway has no requirements regarding where the stocks are kept within the national territory, but the regulation excludes storing the volumes outside of the country.

Demand restraint measures

While the 2011 Act on Business and Industry Preparedness specifies that the government has broad powers to control the distribution of fuels in times of crisis, there is no specific regulation concerning demand restraint measures in Norway, and the government, if required, would use general crisis management provisions to introduce fuel rationing. However, Norwegian authorities consider rationing to be a sub-optimal measure for mastering of peacetime oil supply crises, notably because of the long timeframe needed to prepare for implementation. As with many other countries, the government has powers to control the distribution of fuels during crises. The country’s legislation states that: “where, due to risk of demand shock, supply shortage or logistical failure to ensure that the needs of the population, the needs of the armed forces, the needs of allied military forces in Norway or international obligations related to goods and services are met, the King may make further provisions regarding (a) the assignment of priorities for, redistribution, storage and surrender of goods, performance of services, as well as preparations for and participation in the same, including provisions concerning imports, exports, distribution of goods and sale of goods and services, including measures to regulate sales”. Powers under this clause are delegated to the Ministry of Trade, Industry and Fisheries.